Understand the concept of normal balance in accounting and its significance in finance. Explore how it affects financial statements and reporting accuracy. When an account produces a balance that is contrary to what the expected normal balance of that account is, this account has an abnormal balance. Let’s consider the following example to better understand abnormal balances. We can illustrate each account type and its corresponding debit and credit effects in the form of an expanded accounting equation.

Capital Account vs. Financial Account

Earned capital is an indication of the amount of money that a company is actually taking in for its goods and services. Investors value preferred stock shares for their steady returns, not for their price growth, which can be minimal. They appeal to fewer investors, which is why most companies have relatively few shares of preferred stock than common stock in circulation.

Understanding the normal balance of accounts

For example net sales is gross sales minus the sales returns, the sales allowances, and the sales discounts. The net realizable value of the accounts receivable is the accounts receivable minus the allowance for doubtful accounts. The relationship between normal balances and the categories of assets, liabilities, and equity ensures that the accounting equation remains in balance.

( . Capital/Equity accounts:

Insurance Expense, Wages Expense, Advertising Expense, Interest Expense are expenses matched with the period of time in the heading of the income statement. Under the accrual basis of accounting, the matching is NOT based on the date that the expenses are paid. Revenues and gains are recorded in accounts such as Sales, Service Revenues, Interest Revenues (or Interest Income), and Gain on Sale of Assets.

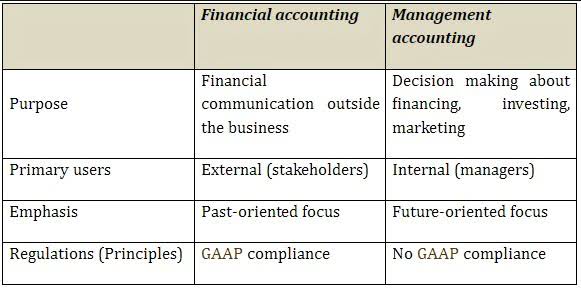

Financial and Managerial Accounting

A young company with big expectations might have significantly more paid-in capital than earned capital. Paid-in capital is not a day-to-day revenue stream for a public company, and its value does not fluctuate. Ensuring they’re not overspending and putting themselves in a difficult financial position. So, when an organization has expenses and losses, it will typically owe money to someone.

Contra accounts

Conversely, when the company receives a payment from a customer for a previously made credit sale, it records a credit entry in the Accounts Receivable account, decreasing its balance. From the table above it can be seen that assets, expenses, and dividends normally have a debit balance, whereas liabilities, capital, and revenue normally have a credit balance. Lastly, we discussed the concept of normalizing entries in accounting, which involve adjustments made to financial records to remove abnormal or non-recurring capital account normal balance transactions or events. Normalizing entries help provide a more accurate picture of a business’s ongoing operations, correcting for one-time events, seasonal fluctuations, extraordinary items, and accounting errors. Having a clear understanding of the normal balance of different accounts is essential for maintaining accuracy and consistency in accounting practices. It allows for proper classification of transactions and ensures that financial statements reflect the true financial standing of the entity.

- Common stock is a component of paid-in capital, which is the total amount received from investors for stock.

- The accounting equation states that assets equal liabilities plus equity.

- For example, if a company borrows $10,000 from its local bank, the company will debit its asset account Cash for $10,000 since the company’s cash balance is increasing.

- Asset, liability, and most owner/stockholder equity accounts are referred to as permanent accounts (or real accounts).

- Similarly, if a company has $100 in Sales Revenue and $50 in Sales Returns & Allowances (a contra revenue account), then the net amount reported on the Income Statement would be $50.

- A glance at an accounting chart can give you a snapshot of a company’s financial health.

Rules of debit and credit

As stated earlier, every ledger account has a debit side and a credit side. Now the question is that on which side the increase or decrease in an account is to be recorded. The answer lies in the learning of normal balances of accounts and the rules of debit and credit. The normal balance is the expected balance each account type maintains, which is the side that increases. As assets and expenses increase on the debit side, their normal balance is a debit.

What is a Normal Balance in Accounting?

If the treasury stock is sold at a price equal to its repurchase price, the removal of the treasury stock simply restores shareholders’ equity to its pre-buyback level. In accounting, a debit balance refers to a general ledger account balance that is on the left side of the account. This is often illustrated by showing the amount on the left side of a T-account. For example, you can use a contra asset account to offset the balance of an asset account, and a contra revenue accounts to offset the balance of a revenue account.

Liability account

The debit side of a liability account represents the amount of money that the company has paid to its creditors. And finally, asset accounts will typically have a positive balance, since these represent the company’s valuable resources. Cash equivalents are short-term investments that you can convert quickly into cash with normal balances.

When you make a debit entry to a liability or equity account, it decreases the account balance. For example, the normal balance of an asset account is a credit balance. While those that typically have a credit balance include liability and equity accounts.